Proven, a developer of zero-knowledge proofs (ZK) technology that helps exchange and asset management clients prove their solvency, has raised $15.8 million in a seed round led by Framework Ventures, a crypto-focused venture capital firm. The round also saw participation from Balaji Srinivasan, Roger Chen, and Ada Yeo.

The recent crypto collapses have shed light on insolvency issues faced by various centralized exchanges, leading to a decrease in customers’ trust in digital asset firms.

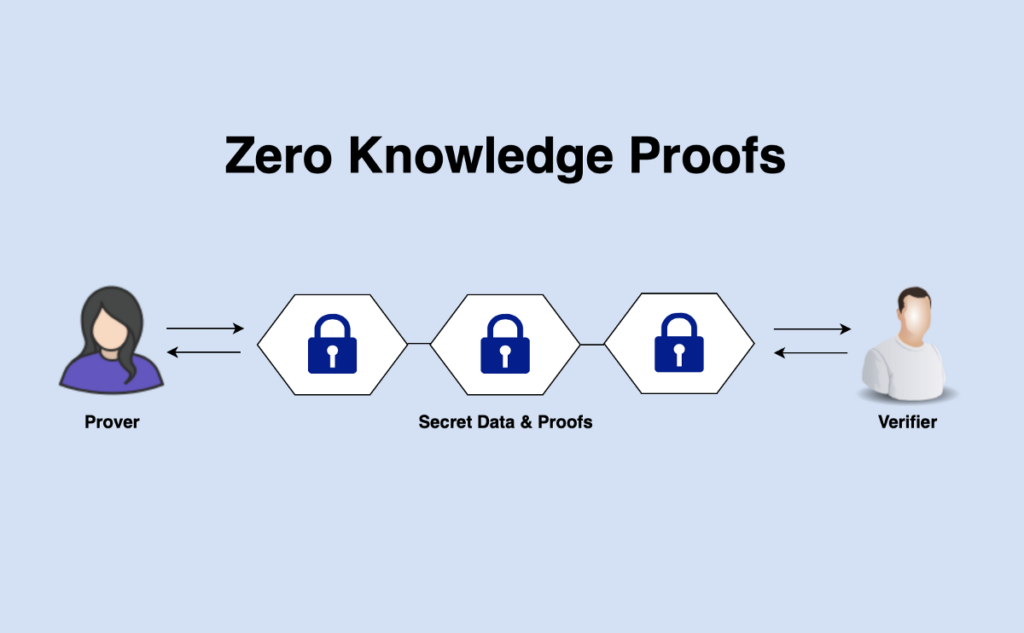

Proven’s technology provides a win-win solution that enables exchanges, stablecoin issuers, asset managers, and custodians to show their assets and liabilities to potential customers, partners, or regulators without compromising on privacy or publicly disclosing sensitive data.

Proven combines ZK proofs, a type of cryptography that ensures anonymity while proving that something is true, and quantitative solutions. The “Proof of Solvency” can be run daily, allowing for increased transparency and trust-building among customers, partners, and regulators.

“The last few months have highlighted an issue that has long plagued both traditional financial and digital asset firms – efficiently fostering trust with customers while maintaining a necessary level of privacy. The absence of this has led to significant distrust and, of course, contagion,” said Proven co-founder Richard Dewey in a statement.

The funds raised will help Proven expand its team and scale its infrastructure. Proven’s client list includes crypto exchanges Coinlist and Bitso, stablecoin TrueUSD, and M11 Credit, an institutional credit underwriter for decentralized finance (DeFi).